Client Background

In addition to contributing to the economic development of India, the client supervises the financial sector in the country, which includes all banks and financial institutions. As a central regulatory body, it maintains monetary stability, operates the Indian currency, and manages the credit/ loan system in the country.

Why Did The Client Come To Dotsquares?

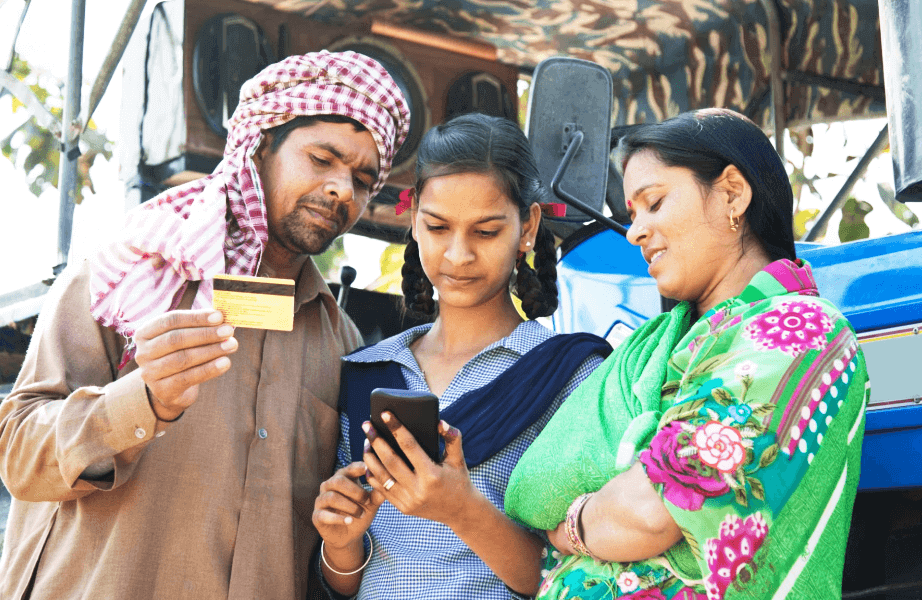

The client was looking to implement a new payment method to manage digital transactions in semi-urban and rural India in collaboration with leading banks in India. As rural India is not well-connected to high-speed internet availability, it is not easy to manage digital transactions with POS devices, Internet and Mobile Banking, Wallets, Credit and Debit cards etc. and there is also a risk of duplicity of transactions.

Since most rural India is not equipped with smartphones, mobile-based payment adoption is not easy. As operation with USSD (*99#) in feature phones is complicated, time-consuming, and involves telecom costs, client was looking for an effective solution. They were looking for a partner for a unique solution that can address these issues and upgrade payment processing in rural and semi-urban India. As part of their search for a reliable partner, they contacted Dotsquares.

Solution Delivered

There was a need for managing transactions in low internet availability and Dotsquares proposed an NFC (Near Field Communication) based prepaid solution where transactions are done using the card and NFC device. NFC is a wireless technology that can manage connections in a short range. Our Java experts prepared a solution for fund transfer that eliminated the need for the Internet. The NFC-based device can be synchronised with the central server of the receiver party and can easily be integrated with the core banking system. While utilising a high-performance tech stack, we performed sandbox testing of the first-ever concept to streamline NFC-based prepaid transactions in the Indian payments and banking system.

Dotsquares proposed us a NFC-based prepaid card solution for rural and semi-urban India where digital payment implementation is a critical issue. We tested the sandbox in two branches in rural areas and got remarkable results as this solution can process payments instantly and accurately.

Results

The solution was released by the client as IND-e-Cash (earlier named ‘eRupaya’). It made it easy to facilitate offline P2M (Peer-to-Merchant) transactions and offline digital payments in remote areas. With NFC-enabled Point of Sale (PoS), it is easy to manage transactions without an active Internet. This Java-based sandbox for banking was successfully tested with a couple of leading banks at Karansar (Rajasthan), Ghargal (Himachal Pradesh). These villages have populations between 1200 to 1600 and during testing, it was able to seamlessly manage around 100 transactions daily. With Dotsquares' solution for banking, payment processing is becoming more efficient for everyone, even without high-tech infrastructure.

THE DETAILS

Client: Regulatory Indian Banking System

Location: India

Industry: Finance, Banking

Development: JAVA

THE TECHNOLOGY

Java

MS-SQL

J2E, J2ME, Java Server Faces, Spring, Struts, EJB 3.0, Servlets, JSP, JNDI, RMI, Tapestry Tiles, Velocity

JavaScript, Ruby

Ajax, Google Web Toolkit

Tomcat, BEA Web Logic, Web Sphere, JBoss

MQ Series, SOA

Hibernate, Java Data Objects